heloc draw period vs repayment period

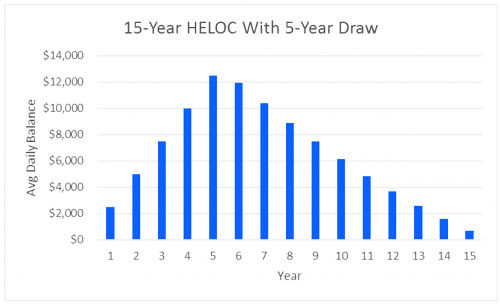

Age of the loan. This provides you with a renewable source of funding during the 10-year draw period.

Essential Differences Between Home Equity Loans And Helocs Cccu

10-year draw period 20-year repayment period.

. Home equity line of credit. Interest-only payments during draw period with variable rate based on Wall Street. As you pay the money back the funds are available again on your HELOC.

Draw Period Repayment Period. How To Use Your HELOC Wisely. At the end of your loan term you can no longer withdraw funds and the balance of the loan becomes due.

This makes a home equity line of credit another good option for making large purchases. It differs from a home equity loan or cash-out refinance though in that this line of credit remains open and available during a set draw period. Lastly theres the home equity line of credit HELOC another type of second mortgage thats secured by your home.

A home equity line of credit HELOC can be a great way for homeowners to tap into their home equity for cash. It allows home owners to borrow against. Once your draw period is over you will no longer be able to access your home equity and you will need to begin paying down your debt.

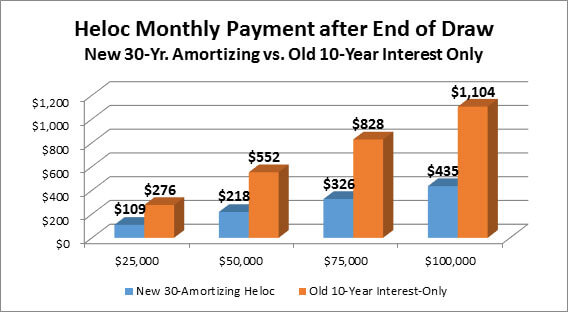

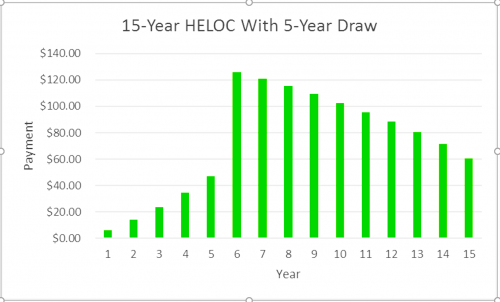

Make a financial plan for your HELOCs draw period and repayment period to avoid hurting your credit by missing payments. If youre taking out a HELOC its best to use the funds only as needed. You should also consider making additional payments during the draw period not just on interest to prevent sky-high payments later on.

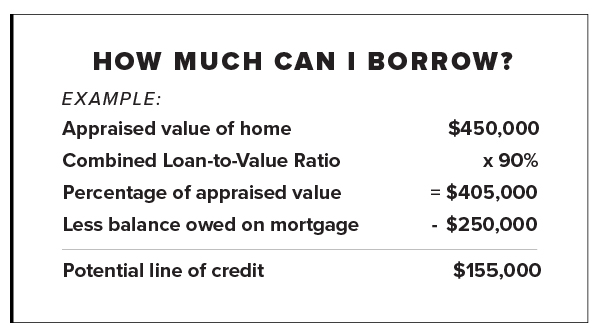

The term of a home equity line of credit can be as little as 5 or as much as 10 years. First is the draw period during which you borrow money and make payments against the interest. During the draw period you can borrow from the credit line by check transfer or a.

The draw period and the repayment period. Understand how the HELOC draw period works. All borrowed funds are secured by the value of the equity in your home.

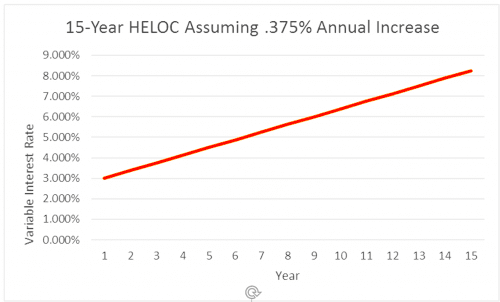

And if possible shop around for a mortgage lender that offers fixed rates rather than adjustable ones. A HELOC can be a great option if youre looking for some flexibility with how and when you access your homes equity. Introductory rate discount for the first 12 months.

You wont start paying down the balance until your draw period expires usually around 10 years. A HELOC has two phases. Borrow against the equity in your home to pay for a variety of expenses.

With a HELOC you typically have a draw period perhaps for 10 years. Then comes the repayment period when. If youre deciding between a home equity loan or HELOC vs.

With a home equity loan or home equity line of credit your goals are within reach. Common types of closed-end credit instruments include. Here are the best HELOC rates right now.

Monthly minimum payments are variable and based on the amount of the line balance and the variable interest rate. 10 ways to get. At the end of a set period the individual or business must pay the entirety of the loan including any interest payments or maintenance fees.

HELOCs have two parts. After the draw period youll have a repayment period of 20 years. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

This allows you to use it whenever you need the funds.

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

Home Equity Loan Vs Heloc Infographic Discover

Home Equity Line Of Credit Heloc Rocket Mortgage

What To Know About Fixed Rate Helocs And How They Work Credible

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Uccu

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Heloc And How Does It Work Prosper Blog

Equity Repayment Home Equity Lending Third Federal

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Vs Home Equity Loan How To Decide

What Is A Home Equity Line Of Credit Heloc And How Does It Work

How A Heloc Works Tap Your Home Equity For Cash

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)